Can You Include Parents Income on Credit Card Application

If you have a task with a fixed almanac bacon, reporting your income on credit card applications is like shooting fish in a barrel. But for millions of students, stay-at-home parents, hourly-wage workers and freelancers, reporting almanac income is much trickier.

You want to tell the truth, merely the applications rarely brand it articulate how you should summate such a number. What's an honest consumer to practise?

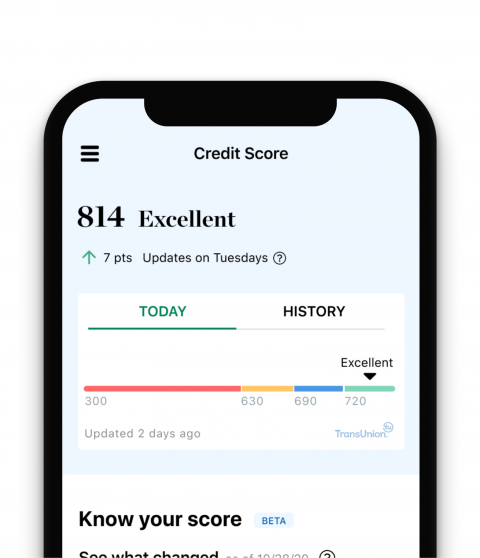

Find the best carte for your credit

Check your score anytime, and NerdWallet will show you which credit cards make the about sense.

What counts equally income

Before the Credit Card Act of 2009 , information technology seemed equally though everyone with a pulse could become a big credit line. Today, that's no longer the case. The Card Human action requires lenders to extend credit only when they believe the borrower has the ability to repay it. The income you report on your credit card awarding is one way creditors decide how much credit they should extend to yous, if whatever.

For those age 21 and older

According to an amendment to the Menu Human action , borrowers over 21 tin can list whatever income to which they have "reasonable expectation of access." This broad definition includes:

-

Personal income.

-

Income from a spouse or partner.

-

Allowances and gifts.

-

Trust fund distributions.

-

Scholarships and grants.

-

Retirement fund distributions.

-

Social Security income.

Have a kid in college? Come across how you can help them:

For those under 21

Borrowers ages 18-xx can report only independent income, which typically includes:

-

Personal income, including regular allowances.

-

Scholarships and grants.

Right now, there are no specific legal guidelines about how irregular income should be calculated. But by and large, you should report only income that tin be verified by tax returns, a alphabetic character or some other certificate.

"Use common sense," says Ira Rheingold, executive director of the National Association of Consumer Advocates. "If you can't prove the income exists, you lot shouldn't list information technology."

Retrieve, when your issuer assigns y'all a credit limit based on your income, it'south not a trust fall. If you lot default, your creditor won't be there to grab y'all; it'll be asking for its money dorsum.

Nerdy tip: Credit card blessing depends on your income, but it likewise hinges on your credit history and your debt-to-income ratio, which is your current debt payments as a percentage of your income.

What doesn't count as income

It's non a good idea to state borrowed money, including student loans, every bit income. Although there's no specific law confronting it, such reporting would go confronting the spirit and intent of the "power to pay" clause in the Card Deed, Rheingold says, and could injure your finances.

"Information technology'south debt, information technology's non income," he says of borrowed money. "In my mind, information technology's a really bad idea, adjoining on the absurd."

When the loans come due, paying dorsum the balances on your cards could prove hard.

When issuers cheque your income

Almost card issuers use a consumer's stated income on applications when issuing a card. Merely in some cases, your creditor may enquire to you to verify your income or utilise an income modeling algorithm to guess your earnings, explains Natalie Daukas, a senior production manager at Experian.

Income modeling

Income modeling algorithms, produced past credit bureaus, estimate your income based on your credit written report data. Creditors typically use these to double-check stated incomes or make up one's mind credit line increases on existing accounts, Daukas says. For credit bill of fare companies, these estimations are an easy way to quickly assess a borrower'due south financial standing, without requesting access to tax documents and other verification.

Financial reviews

If you're spending a lot or applying for several cards within a short time, some creditors volition run what's called a financial review to verify your income. Such reviews are expensive for creditors to conduct, though, and tend to be rare.

During such a review, you may be asked to provide taxation returns and other documents to verify your income. If you can't provide proof of your reported income, the creditor may lower your credit limits or close your accounts.

What happens if your estimated income is off

Estimating your annual income in good faith and coming up short is completely understandable. Inventing self-employment income, grossly inflating your actual income or listing a nonexistent employer, though, is a different matter entirely.

If a creditor can prove in court that you committed fraud when applying for a sure carte, information technology could brand that debt unable to be discharged in a defalcation proceeding, says Scott Maurer, an associate clinical professor of consumer law at Santa Clara Academy. On very rare occasions, people have too been convicted of fraud for lying almost their income on credit card applications, resulting in steep fines and jail time.

Merely if you lot've reported your income to the best of your knowledge, don't worry about this.

"Proving fraud is not piece of cake, and a consumer who truthfully lists monthly income that happens to be irregular is not going to come shut to losing such a suit," Maurer says.

The bottom line

Listing all the income you have access to can assistance you secure a college credit line and therefore more spending ability. But it doesn't mean you're immune from overspending. Borrow sparingly, endeavor to avoid conveying a balance and readjust your budget if you face an unexpected income change, such equally a chore loss or a pay cut.

Your creditor will do only and so much to prevent you from defaulting, based on your stated income. The rest is up to you lot.

guajardotheyet2001.blogspot.com

Source: https://www.nerdwallet.com/article/credit-cards/report-income-credit-card-application

0 Response to "Can You Include Parents Income on Credit Card Application"

Postar um comentário